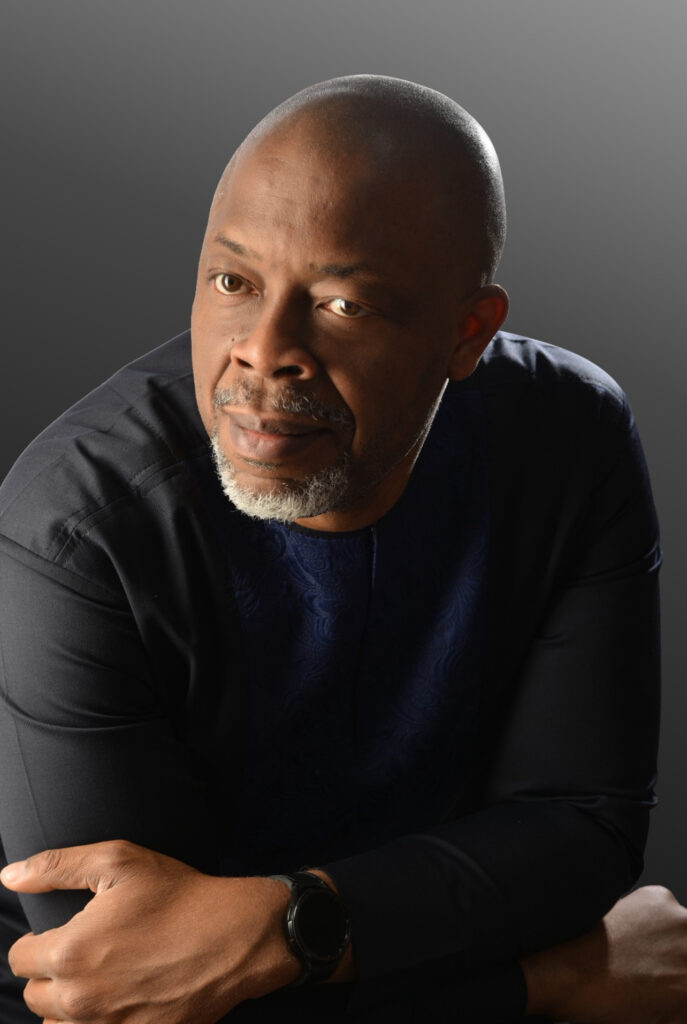

Mike Ogbalu III has more than eight years of sound IT industry experience in planning, deployment, and management of enterprise-wide infrastructure, as well as more than 15 years’ banking experience in Retail Banking, Commercial Banking and E-Business. He managed the E-Business Group of Afribank (now Polaris Bank) and represented Afribank on the boards of Valucard Nigeria (now UPSL) and ATMC.

Mike spent the last six years in Payments and Technology joining Interswitch Group initially as Divisional CEO – Interswitch Financial Inclusion Services, where he was responsible for driving a mandate to create the largest agent network and thereby becoming a prime facilitator of financial inclusion in Nigeria. Later, he moved on to make Africa’s most successful card scheme truly pan-African and expand its footprint globally as Chief Executive Officer of Verve International. Today, as CEO of PAPSS, he is overseeing the building of a continent-wide payment infrastructure that will help to accelerate trade on the continent.

Mike is an Electrical/Electronic Engineer with an MBA from the prestigious Lagos Business School. He is currently a board member of the mobile payments scheme board, an advisory board member of the Bridge International Academies, a Grand Patron of IAMCP-WIT Nigeria (International Association of Microsoft Channel Partners – Women in Technology) and a Fellow of The International Academy of Cards and Payments. In 2012, he was recognized with the award of Card Personality of Year for his work at Ecobank.

About PAPSS

PAPSS – the Pan-African Payment and Settlement System – is a cross-border, financial market infrastructure enabling payment transactions across Africa.

PAPSS enables the efficient flow of money securely across African borders, minimizing risk and contributing to financial integration across the regions.

Pan-African payments:

Leading-edge technology connecting African banks, payment service providers and other financial market intermediaries enabling instant and secure payments between African countries

Instant payments:

Instant payments made by originators to beneficiaries in their local currencies, no matter where they are in Africa

Simplified payments:

Simplifying the historical complexities and costs of making payments across African borders, providing operational efficiencies that open up vast economic opportunities for all stakeholders.

Benefits of PAPSS:

PAPSS addresses the historic challenges of making payments across African borders, adding value through a common African market infrastructure for all stakeholders, from governments, banks and payment providers to corporates, small enterprises and individuals.